KEEPING THE RISK TIGHT IS KEY

- Scott Pulcini

- Dec 18, 2019

- 1 min read

In slow times like the recent days, I find NQ to be the ideal trading product, as it moves a bit more than ES, giving me more trading opportunities.

This morning I missed part of the action as I was trying to set up a screen recording program, but I was still able to take a some nice trades.

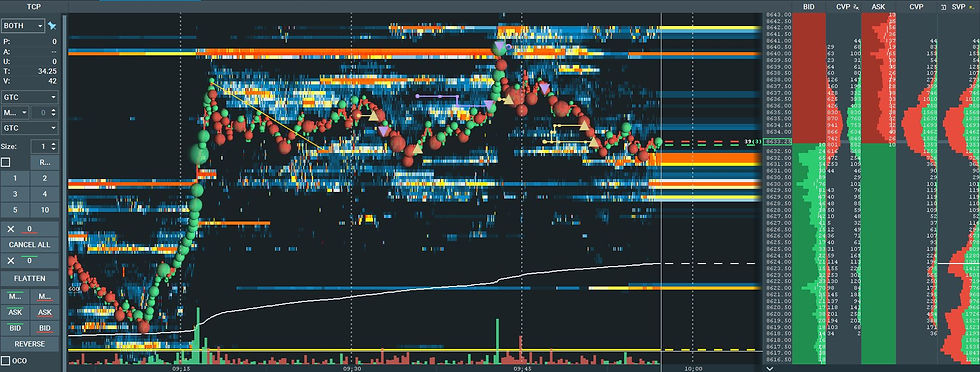

After this nice rally (which I completely missed..), there was some sideways action, but it looked like they wanted to go take the 40 level so I got in with a small position at 35, only to get stopped out one point lower. So I waited for the price to come back to the LVN of the higher range VP and got in long as soon as some buyers stepped in at 32.75 and got out at 36. Then shorted the 40.50 to 36.50, then again another short from 37.5 to 34.50 and 33.25

I don't mind at all taking a 1 or 2 points loss as long as I can get 4 points or more on my profitable trades.

Comments